- Pitch Reviews

- Posts

- 2024 Valuation Trends: Private vs. Public Markets

2024 Valuation Trends: Private vs. Public Markets

Why Equity Crowdfunding Startups Command Higher Revenue Multiples Compared to Public Companies

CHART OF THE WEEK 📈

By Teddy Lyons | Read

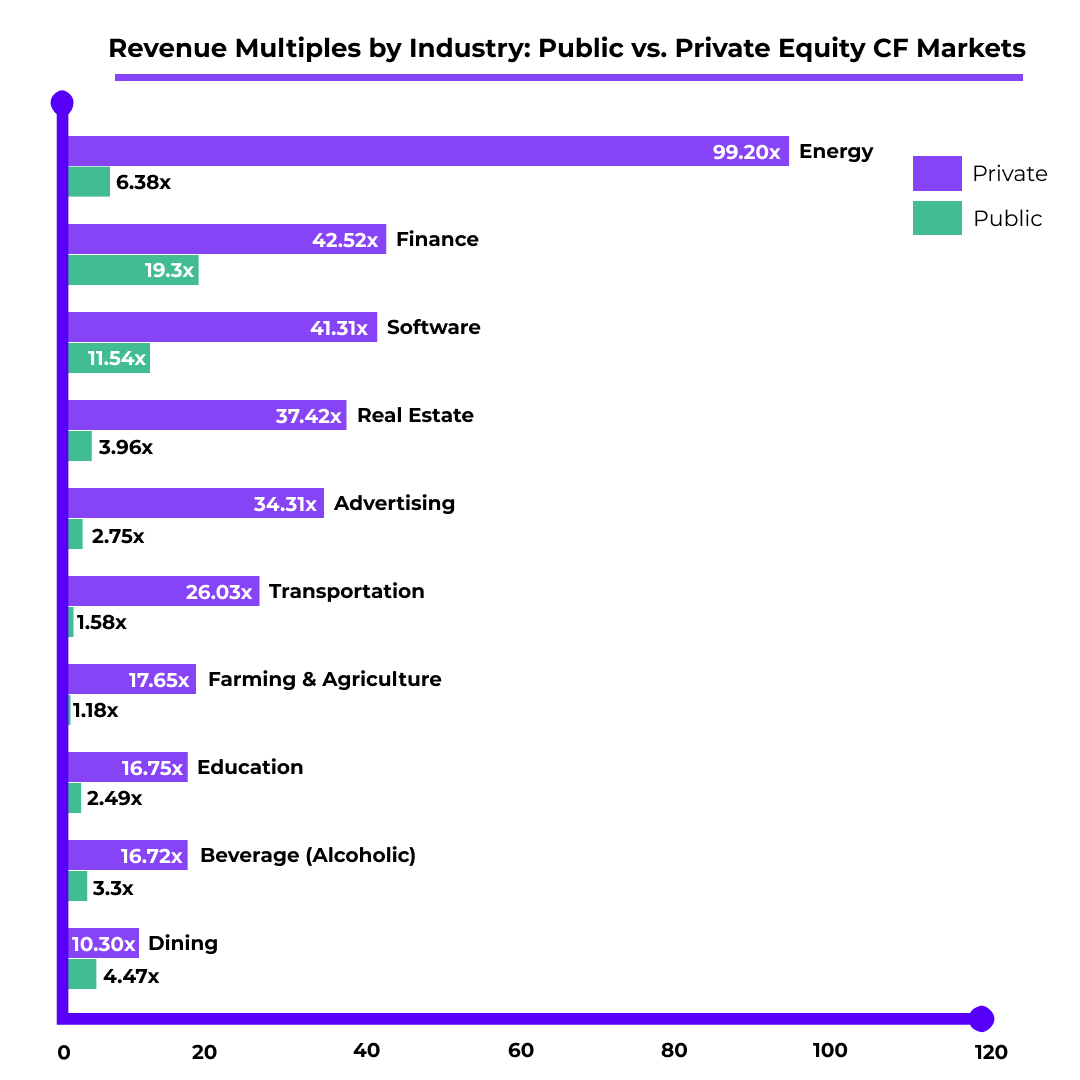

In this Chart of the Week, we revamp a popular chart comparing the valuation-to-revenue multiples of industries in both the private and public markets for 2024. While some of the industries are not exact matches, the comparisons still provide a nice visualization of just how much higher private market valuations tend to be in similar industries.

Note: For public companies, we used enterprise value and sales multiples. For private companies, we only included companies with revenue above $50,000.

Again, as expected, the valuation-to-revenue multiples for public companies tend to be much lower than the revenue multiples of companies raising in the Regulation Crowdfunding and Regulation A markets. Startups are usually expected to see hypergrowth within three to five years of their investment opportunities going live. Therefore, investors are willing to pay a much higher premium on this future growth, leading to higher overall revenue multiples. Public companies, on the other hand, tend to be far more mature and developed with very stable future cash flows. Therefore, given the lack of hypergrowth, investors pay a far lower premium to invest in these types of public companies.

Energy, Power, and Natural Resources once again had one of the highest valuation-to-revenue industries in equity crowdfunding, reaching nearly 100X in 2024. Energy startups in the equity crowdfunding space are generally renewables focused companies looking to disrupt the status quo and contribute to the phasing out of fossil fuels. However, many of them only have pilot revenues and have not successfully commercialized yet, instead baking in future growth to its high valuations. Public companies in the renewable space, on the other hand, are generally fully commercialized and scaled up, leading to much lower valuation-to-revenue multiples.

There is so much to unpack here, so stay tuned to the investment roundtable to hear more discussion on revenue multiples in equity crowdfunding!

INVESTMENT ROUNDTABLE

By Sam Fiske / Watch

Investing in startups can offer exciting opportunities—but it’s not without risks. This week, the Investment Roundtable team uncovers the top red and yellow flags investors must watch for when assessing online startup offerings.

Learn about:

🚩 Red flags like low runway and unclear valuations.

⚠️ Yellow flags, including insider share sales and repurchase rights.

🛠 Expert tips to evaluate deal terms and reduce risk.

Stay informed and protect your portfolio from risky investments.

PITCH REVIEW 💸

By Teddy Lyons \ Deal Report

Brief: WeatherFlow-Tempest is an advanced weather technology company that offers a comprehensive home weather monitoring and forecasting solution. Their flagship product, the Tempest Weather System, is a sophisticated smart weather station that provides hyperlocal, real-time weather data and predictions. By combining data from a vast network of individual Tempest stations with multiple weather information sources, the system delivers incredibly precise, location-specific weather insights. The technology uses intelligent algorithms to track temperature, wind speed, precipitation, humidity, and other meteorological conditions, making it valuable for homeowners, outdoor enthusiasts, farmers, and professionals who rely on accurate weather information for planning and decision-making. The company has strong product-market fit, growing revenue to $12.2M in 2023 and 5M active users. The company has raised twice previously on StartEngine, raising $1.6M at a $41.1M valuation in 2023 and $2.5M at a $32.3M valuation in 2022.

Key People: Buck Lyons is the Co-Founder and CEO of WeatherFlow-Tempest. He previously founded and led Synoptic Data, a Public Benefit Corporation aiding in the exchange of environmental data to allow government agencies, businesses and the public access to high quality information. He also Co-Founded and served as CEO of WFn Holdings for 21 years, another weather data startup. Additionally, he served as CEO of CozyBoots, an online footwear retailer that he sold to Shoebuy in 2011. He holds an MBA from Stanford

Edward Dingels serves as COO of WeatherFlow having previously served in multiple C-Suite roles at GroundTruth, a large media and advertising platform. Additionally, he served as a Sr. Engineering Director at Earth Networks, a precision weather data company. He holds an MBA from the University of Maryland.

David St. John is a Co-Founder of WeatherFlow and serves as the company’s CTO. He also co-founded WFn Holdings, serving as the company’s Chief Information Officer. He also served as CIO of Cozyboots and a Software Engineer at General Dynamics.

Here's what we like: WeatherFlow-Tempest has achieved strong product-market fit over the last several years, with over $50M in lifetime revenue and over 125,000 paying customers. The company has strategic partnerships with some of the world’s largest companies, including Amazon, Weather Channel, and Disney. Since the company’s previous raise, WeatherFlow has grown the number of installed Tempest sensors to 80,000 from 45,000 and has now launched commercial grade sensor systems for business customers. Weatherflow is led by a team of industry veterans that have continued to grow revenue substantially while lowering overall net loss. And finally, the company is fairly valued at a valuation-to-revenue multiple of just 3.37X.

Here's what we don't: Firstly, Weatherflow is operating in a small market, with U.S. Weather Forecasting Systems valued at just $1.1B growing at 6.6%. Additionally, while the company has achieved product market fit, the slowdown in revenue growth is concerning, not reaching the 50% threshold in 2023 that is usually the minimum we would look for as startup investors. Finally, the company has about 7 months of runway. While this is solid for a startup, the company will need to continue fundraising to keep up with its current burn rate, as well as any ramp up in burn that may occur after this raise.

Would you invest in WeatherFlow-Tempest |

LAST POLL RESULTS

Would you invest in Jupiter?

🟨⬜️⬜️⬜️⬜️⬜️ 👍 (2)

🟩⬜️⬜️⬜️⬜️⬜️ 👎 (2)

4 Votes

STAFF PICKS 🌶️

Virtuix is the creator of Omni, an omnidirectional treadmill that allows users to walk and run inside virtual worlds. Omni is a first-of-its-kind motion platform that enables players to walk and run in 360 degrees inside VR games and other virtual worlds. They have hosted over 3 million plays with its database of over 400,000 players and sold products worth more than $18 million.

Pre-Money Valuation: $201 million

Minimum Investment: $498

Trendex is building a platform that connects the world’s top athletes with their fanbases. They offer engaging and innovative experiences to the fans and enable them to own Limited Edition Tokenised Talent Cards representing young talents or established celebrities. The platform is being endorsed by Timberwolves Rudy Gobert and Karim Benzema and has grown from a public alpha to a seven-figure revenue in 2023.

Valuation Cap: $30 million

Minimum Investment: $100

SunTrain aims to remove bottlenecks in transmission that delay new renewable projects. Using a wire-free alternative to the grid using existing rail networks to move renewable energy equivalent to the output of five natural gas plants. The company has developed its technology and is partnering with utility and NREL for a 384 MWh grid-connected pilot.

Valuation Cap: $15 million

Minimum Investment: $250

What did you think of this newsletter? |

Enjoyed this newsletter? Forward it to an investing-minded friend and have them signup here.